The rising inflation rates in Brampton are placing significant financial pressure on residents, forcing many into debt as they struggle to cope with the increasing cost of living. Inflation, fueled by factors such as higher fuel prices, supply chain disruptions, and increased demand for goods and services, is eroding the purchasing power of many households in the city.

The rising inflation rates in Brampton are placing significant financial pressure on residents, forcing many into debt as they struggle to cope with the increasing cost of living. Inflation, fueled by factors such as higher fuel prices, supply chain disruptions, and increased demand for goods and services, is eroding the purchasing power of many households in the city.

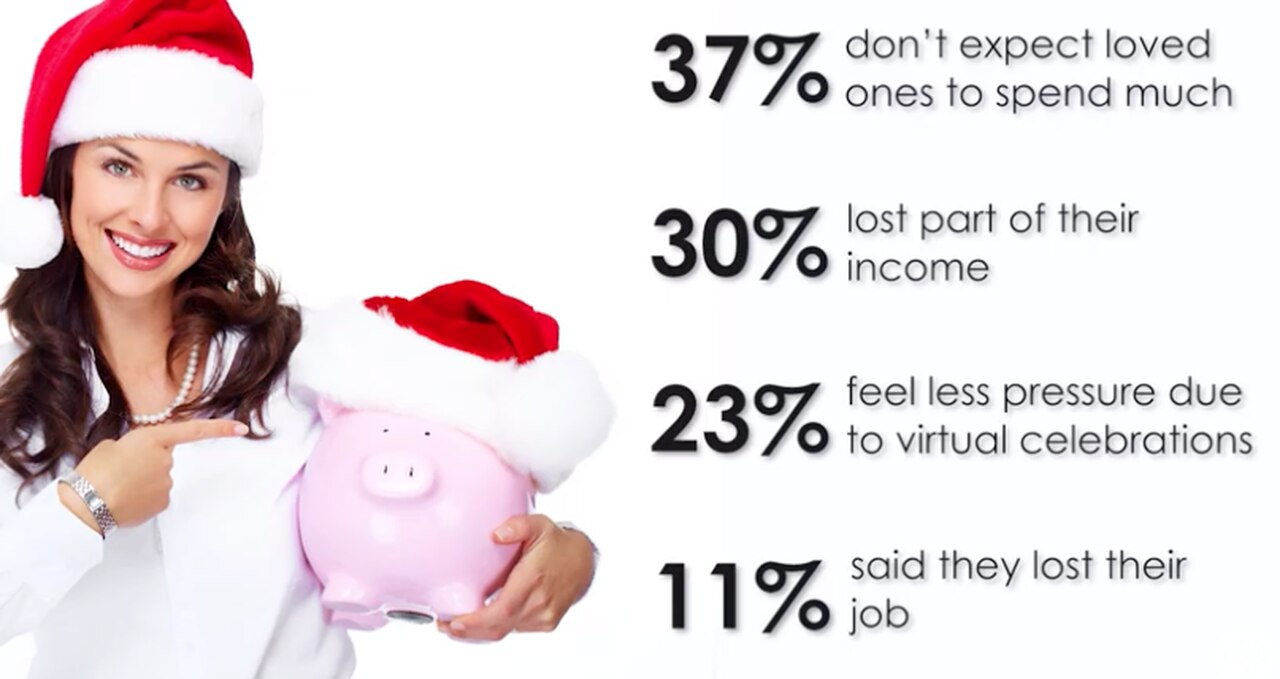

With inflation outpacing wage growth, many residents are finding it increasingly difficult to make ends meet. Some are turning to Brampton payday loans, and other forms of high cost borrowing to cover their expenses, leading to a growing debt burden.…

Read more